The Consequences of Non-Competitive Listings Part 2

The Consequences of Non-Competitive Listings Part 2

The Dangers Of Overpricing

Market value is a tricky number, because comparable-sales data do not always provide a good guide to a home’s value. Nearby homes that have sold in the past six months or so may be quite different from yours in appearance or condition, and there may be too few recent sales to get a proper valuation. However, pricing can be determined by the sold comps and the current construction costs.

As a seller, focusing on maximizing your profit rather than current market trends could cause you to miss the right buyer for your home. Overpricing your home DOES have consequences.

Consider these “famous last words” of pricing pitfalls:

- “Buyers who really like my home will make an offer regardless of the listing price.”

- “I can always come down on price when an offer comes in.”

- “My home is so much nicer than all of the others. A higher price is justified.”(views, amenities, etc)

- “I don’t have to sell right away.”

- “I want to test the market first to see what I can get.”

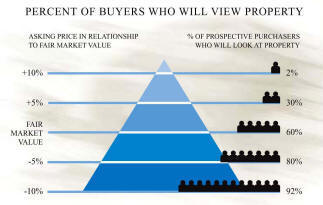

An asking price that is beyond market range can adversely affect the marketing of a property. Overpricing when you list your house can come with clear dangers:

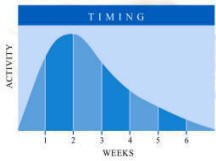

- The best time to capture a buyer is in the first weeks when sales professional and buyer interest is the highest. Don’t squander this critical marketing period.

- Fewer buyers are attracted, and fewer offers received.

- The property attracts “lookers” and helps competing houses look better by comparison. I see this all the time as a overpriced home helps sell the competitively priced home.

- Sellers who start high and stay high can be branded as unreasonable.

- Sales professional enthusiasm dims on overpriced homes.

- Advertising and other marketing efforts are neutralized. Marketing time is prolonged, and initial marketing momentum is lost.

- Sales professionals and buyers tend to overlook and discount aged properties. To prevent your house from being overlooked, price it fairly to keep sales professional’ and buyers’ attention.

- If a property does sell above true market value, it may not appraise, and the buyers may not be able to secure a loan.

- The property may eventually sell below market value.

- Aged properties draw lower offers. Early offers tend to be higher, so price carefully initially to get fair offers.

Homesellers’ opinions of their properties are often clouded by sentimentality or motivated by their needs, future goals and objectives and not grounded in the real facts of market value. The biggest mistake home sellers make is confusing the price or costs with property value. “Market value is determined by how the home is valued by the market, not by one individual. It has nothing to do with how much a seller paid for the house; or how much he is hoping or “needing” to profit from the house.”

I asked a number of veteran brokers and appraisers the telltale signs that a home is overvalued, and this is what they said:

1. Your home is priced well above neighboring properties.

The first thing brokers do before they recommend a price to a seller, is they look at the sales prices of the last three sales of comparable-sized homes in the neighborhood, within a 1 mile radius. You can conduct your own research to determine a reasonable price before you hear estimates from brokers. Do a quick search online to see what neighborhood homes are selling for, and there are some tools that can help determine a roundabout value of your home based on your zip code and other factors. You can not compare your home in one neighborhood to a comparable home in a more upscale neighborhood several miles away.

2. After a couple months, you still haven’t received an offer.

Don’t panic just yet. This isn’t true for all homes, (it’s not uncommon for high-end homes, for example, to stay on the market for years) but there should be a flurry of showings and interest in the first four to six weeks the home is on the market if it’s priced properly. Although one assumes that overeager buyers are indicative that the price is low, realtors say competitive bids are more likely indicative of a reasonably priced home. You should be informed as to what the average days on the market for your area by your agent aand your agent should

3. You spoke to several realtors before you hired the one who recommended the highest price for your home.

Realtors seldom want to take a property that is overpriced, simply for the fact that the chances of selling it are slim, and that means their chances of making a commission are greatly reduced. Common sense is that you should speak with several realtors before choosing one to represent you, but if you consistently hear a ballpark price that seems low to you, the price may be right. Realtors are intimately familiar with most real estate activities in their market, and they should have the best idea of how a home should be priced.

4. There aren’t any scheduled showings.

Immediately after the home hits the market, there should be at least a few appointments for showings. If there aren’t, it might indicate that local brokers think the home is overpriced and therefore aren’t showing it to their clients. Realtors suggest that after a month, if there is very limited interest in the home, it’s not too late to reduce the price, but it’s important to act quickly in order to sustain some interest.

5. The home is priced for expensive, unique amenities that may not hold broad appeal.

Your family may have enjoyed endless hours of fun in your indoor badminton court, but not everyone loves badminton as much as your family does. The more customized the home’s amenities, the less likely the seller is to see their value in the sales price. Putting an overpriced high value on views, for example may not appeal to everyone.

More often, though, pricing your home too high works against you in some important ways.

1. Agents react. Real-estate agents — yours and the buyers’ — may not want to waste time with a home that’s unlikely to sell. Though a higher price means a bigger commission, agents might figure they can move two or three homes in the time it would take to sell yours, earning more even if each offers a smaller commission than your property does.

2. Buyers react. Buyers who like your house but pass on your property because of the price may find something else and close a deal before you drop your asking price to a level they’d accept.

Setting a proper sale price is both an art and a science. A key step is to shop carefully for an agent who can help you, looking for one who is very familiar with your community.

I know the Aldea community, its homes and its property values. I have been involved in this community since 2000, before there were streets and lots plotted. I have lived through the economy bubble and the burst and now the slow rebirth. I specialize in properties on the west and northwest side of Santa Fe.